Trump’s Return to the Robber Baron Age

The United States’ leading plutocrats are spending a great deal of time in Washington and walking away with a lot of prizes. But this is just the start.

October 13, 2025

A Strategic Assessment Memo (SAM) from the Global Ideas Center

You may quote from this text, provided you mention the name of the author and reference it as a new Strategic Assessment Memo (SAM) published by the Global Ideas Center in Berlin on The Globalist.

In another era, the U.S. Department of Justice and the U.S. Federal Trade Commission would be using their anti-monopoly powers resolutely.

Their common goal would be to prevent the emergence of a giant AI cartel in the United States that could have enormous global power. And the U.S. Congress would be holding public hearings to evaluate the dangers.

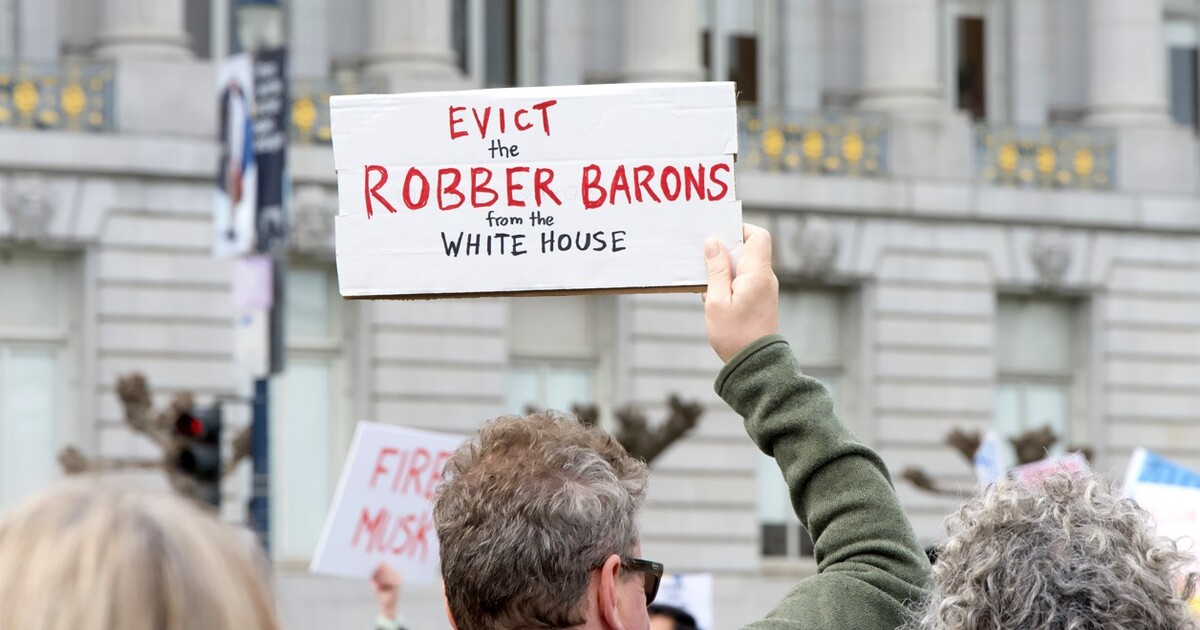

A very different world

But we live in a very different world today, one that harkens back to the “Robber Barons” of the “Gilded Age” in the 19th century. While the unfolding revolution is most dramatic and concerning in the area of AI, it also extends to the world of finance and media.

Today, under Trump, the AI tycoons have the freedom to do absolutely as they like. What’s more, given the massive investments that are required to maximize AI’s impact on every aspect of humanity’s future, a cartel is taking shape.

AI pretty much is an all-male preserve and, in its U.S. variant, includes META’s Mark Zuckerberg, Amazon’s Jeff Bezos, Microsoft’s Satya Nadella, Nvidia’s Jensen Huang, Alphabet-Google’s Sundar Pichai, Apple’s Tim Cook, Tesla’s Elon Musk, Oracle’s Larry Ellison and Open AI’s Sam Altman.

Altman’s central role

Open AI, the inventive genius enterprise run by Sam Altman, is at the center of this cartel. Microsoft is a significant investor in the company and will have a key role in its business strategy.

Oracle will be investing heavily and working in partnership with Open AI to build vast data centers. Nvidia is investing around $100 billion as Open AI is a prime user of its highly advanced chips. Nvidia’s direct rivals in developing chips, AMD and Broadcom, have also done financial deals with Open AI.

This cartel in development could well be the unrivalled, dominant force in how AI evolves, and is deployed for good — or not so good.

Elon Musk will strive to compete, but he may well, in the end, find a way into this cartel. He is suing Sam Altman today, but they used to be partners years ago and maybe again.

Interesting questions are if and when the Chinese will be able to compete with the U.S. cartel. Europe and the rest of the world will almost certainly be dependent on the U.S. group.

Banking’s new power

Meanwhile, Donald Trump sees massive income for the U.S. government being generated from the privatization of two government-owned agencies that between them effectively support around one-half of all U.S. home mortgages — Fannie Mae and Freddie Mac.

The most powerful bankers in the country, including Goldman Sachs, J.P. Morgan Chase, Morgan Stanley, Citigroup and others, have all had Oval Office meetings with Trump to pitch their services.

Estimates about combining the two agencies and taking them public suggest a valuation of around $500 billion. This would be the biggest public stock market offering in U.S. history and would obviously involve huge fees for the banks that manage the offering.

Trump’s decision

Will Goldman Sachs chief David Salomon be able to offer Trump more convincing arguments than J.P. Morgan Chase’s Jamie Dimon?

Nobody knows the degree to which Trump will be influenced by the bankers or by the Wall Street billionaires in his cabinet who are deeply involved in the planning, Treasury Secretary Scott Bessent and Commerce Secretary Howard Ludnik.

One interesting question is whether an old Trump grudge against the biggest U.S. banks which refused to finance the Trump Organization in the years before he became a politician will influence his decision?

Insatiable J.P. Morgan

The United States’ biggest banks have strong profits, but they are nevertheless working hard to convince the authorities at the Federal Reserve Board and other agencies to sharply reduce regulations.

The effort is led by J.P. Morgan Chase, by far the largest bank in the world (excluding China’s state-owned big four banks) with assets of over $4 trillion. Its boss, Jamie Dimon, wants ever greater growth. His influence in Washington and the bank’s lobbying power is considerable.

There are strong prospects that Trump and Bessent will support deregulation, that the U.S. Congress will applaud and that the increasingly Trump-dominated Fed will sign on.

Larry Ellison, the U.S.’s next media tycoon

Now that the nonagenarian media tycoon Rupert Murdoch is no longer in Donald Trump’s camp, the U.S. President is busy putting somebody else into the place.

Larry Ellison, the founder of Oracle, a long-time Trump friend and supporter as well as the world’s second-wealthiest businessman, along with his son David is moving with extraordinary speed to build the largest and most influential media empire in the United States.

Trump’s direct engagement is a key part of that power equation. While details have not been revealed, it is now probable that Trump has decided that Oracle will be the most powerful member of the consortium that makes up the new owners of TikTok social media with its 150 million active monthly users.

Lest we forget, the manus-manum-lavat principle is still in full force. After Paramount’s affiliate CBS TV paid $16 million to Trump to settle a meritless lawsuit, the Federal Trade Commission approved the purchase of Paramount by David Ellison’s Skydance company. A big Ellison bid for Warner Brothers media is in prospect, and likely to win Trump’s blessing.

More deals with plutocrats

Deals also abound outside the Oracle radius. Apple endeared itself further by terminating the distribution of an app that people could use to track the movements of immigration agents.

Apple and META are both securing soft deals from antitrust authorities. Elon Musk’s SpaceX is notching up a series of new contracts with U.S. government agencies.

Trump announced that the government is taking a 10% stake in Intel to help it become competitive again, while he did deals with Nvidia and AMD under which the U.S. government has allowed them to sell their chips to China in exchange for taking 15% of the sales revenues.

A bonus for a friend

Trump is also very interested in pursuing the U.S. government’s control of rare earth and other minerals. In a bizarre deal, Trump has recently announced that the government is buying 10% of a minor Canadian company for $35.6 million.

A significant shareholder in this company, Trilogy Minerals, is Paulson Investment Company — controlled by New York financier John Paulson.

Paulson supported Trump’s 2016 election campaign and organized a fundraiser for Trump last year which raised $55 million. No sooner had Trump announced the acquisition of Trilogy Minerals, that the company’s share price soared from about C$2 to over C$7 — a nice bonus for Mr. Paulson.

Conclusion

The United States’ leading plutocrats are spending a great deal of time in Washington and walking away with a lot of prizes. But this is just the start.

Trump wants to encourage more deals, more purchases by the U.S. government of shares in private companies and ever more business deregulation.

Meanwhile, just consider, new data from Altrata show that the United States is by far the largest wealth market in the world, home to 38% of the total ultra-high-net worth (UHNW) individuals, with assets of over $30 million each. That is more than the combined share of all other countries in the top 10 countries.

There are over 192,000 Americans in the UHNW segment, with a combined wealth of over $22 trillion. All of them are doing very well, at least so far, in the new Trump era.

Takeaways

The U.S.’s biggest banks have strong profits, but they are nevertheless working hard to convince the authorities at the Federal Reserve Board and other agencies to sharply reduce regulations. The effort is led by J.P. Morgan Chase.

Now that the nonagenarian media tycoon Rupert Murdoch is no longer in Donald Trump’s camp, the U.S. President is busy putting somebody else into the place — Larry Ellison, the founder of Oracle, a long-time Trump friend.

The U.S.’s leading plutocrats are spending a great deal of time in Washington and walking away with a lot of prizes. But this is just the start.

Trump wants to encourage more deals, more purchases by the U.S. government of shares in private companies and ever more business deregulation.

The U.S. is by far the largest wealth market in the world, home to 38% of the total ultra-high-net worth (UHNW) individuals, with assets of over $30 million each. That is more than the combined share of all other countries in the top 10 countries.

A Strategic Assessment Memo (SAM) from the Global Ideas Center

You may quote from this text, provided you mention the name of the author and reference it as a new Strategic Assessment Memo (SAM) published by the Global Ideas Center in Berlin on The Globalist.